Here is the letter I have completed for submission to the Senior Counsel - Office of the Constitution of Law Attorney General's Department. Acknowledgement to Facebook Group posters who already submitted their letters and provided copies in threads.

________________________________________________

Dear Senior Counsel,

I request for you to refer to enclosed annexures outlining my dire circumstances as a direct consequence of the Queensland Land Tax and Absentee Surcharge amendments introduced by the Queensland Labor Government under the command of Premier Annastacia Palaszczuk. I am at my wits end and extremely desperate to seek intervention by the Commonwealth to deem this amended legislation unconstitutional and therefore unlawful.

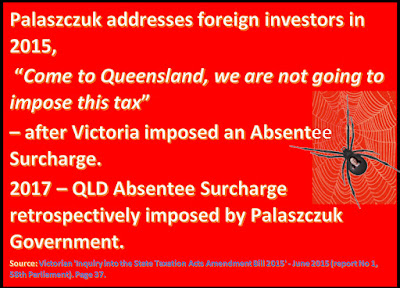

This amended legislation was announced in the May 2017 budget and made retrospective to back capture absentees (as defined in the Queensland Land Tax Act) from July 1, 2016.

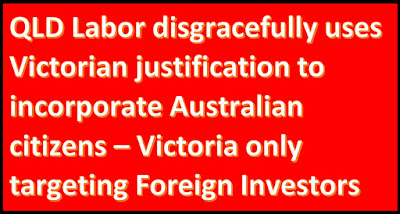

Uniquely, unlike any other other State in Australia that has implemented absentee surcharges, Labor decided to include Australian citizens in the definition of an Absentee, hence affecting people like me and others who own and hold a property in Queensland, who for myriads of reasons are overseas for more than six months of a financial year.

Not being an expert in the area of Constitutional Law, I apologise in advance for not being across the legislation in whole with the relevant nuances and complexities therein. But I wish to draw attention to the Queensland Land Tax Act and how this law has been implemented contrary to the Australian Constitution.

In essence, I believe that me and all others subjected to these taxes are being discriminated against and being treated unfairly and unjustly by the Queensland legislation. Referring to Section 117 of the Commonwealth of Australia Constitution Act, it is explained in an overview section on page xiii,

“Section 117 prohibits the Parliament of a State from discriminating against non-residents of that State. It provides, in effect, that a resident in, say, Victoria shall not be subject to any discrimination or disability in, say, Queensland unless the person would also be subject to that disability or discrimination as a resident of Queensland.”

I am hoping that this explanation includes extending that to the ‘non-residents’ who are also outside Australia at the time. If absentees can be included then this legislation is unfairly discriminating against them. Absentees are:

• Subjected to a much higher Land Tax rate than residents – which is calculated for absentees at a reduced threshold (from Land Valuation starting at $600,000 for residents, down to $350,000 for non-resident/absentees) and;

• Are subjected to an Absentee surcharge added on at 1.5% from threshold of $350,000.

Absentees are also subjected to the same range of numerous taxes, rates, fees and other running costs of holding a property that provide revenue to State and Federal Taxes. This is more the case for Australian citizens who have more obvious interconnections with Australia (than non-Australian citizens – foreign citizens) with savings, Superannuation, re-investments in Australia, financial supporting family members in Australia, etc.

The combined Land Tax and Absentee Surcharges well and truly exceed what a non-absentee resident would be paying in taxes. The amount of additional taxes charged to Absentees is totally disproportionate and grossly excessive.

In addition, the Land Tax and Absentee Surcharge are indexed to increase at the same percentage rate alongside increasing Land Valuations conducted and assessed annually by the QLD Department of Natural Resources and Mines.

The Queensland 2017 May budget was announced by Labor Treasurer at the time Curtis Pitt.

I refer to extracts quoted in the Brisbane Times news article titled, 'I would never have invested into Queensland property' by reporter Felicity Caldwell published online on 18 July, 2018:

• The budget papers say: "Absentee owners benefit from a high standard of services and infrastructure delivered and maintained by a broad range of taxes. The surcharge will ensure absentee owners of land make a further contribution. This will have no impact on Queensland residents.”;

• A government spokeswoman said it was Queensland’s longstanding position that absentees were subject to higher rates of land tax to account for the fact they were “generally not subject to the range of taxes used to deliver the high-quality services and infrastructure that ultimately contribute to growth in Queensland property values”.

“These rates apply to people who do not ordinarily reside in Australia, including a person for more than six months ending on June 30, however there are also a number of exemptions for people working overseas,” she said.

These explanations to justify the amended Land Tax and Absentee Surcharge are flawed in that:

i) Absentees ARE generally subjected to the same range of taxes that non-absent residents are subjected to. I have outlined the range of taxes absentees are already paying. The only additional taxes I can think of that may not be collected by the Queensland Government would be for perhaps transport costs (whether that is public or private transport vehicle registration and relevant insurance whereby there is GST collected and whether or not the absentee uses those services in Australia anyway – their choice that should not even be part of the scrutiny used by government to determine if absentees pay enough tax), additional utility charges (electric, water, internet, telephone) that collect GST and local tax. However, absentees that have family members residing in their homes or are renting out investment property/ies would have tenants paying for those utilities, albeit connection rates and their subsequent taxes being borne by the absentee. There are several absentees as well – for instance Fly-in, Fly-out workers and periodic travellers, or who have family members still residing in their homes who would not disconnect services, would have vehicles registered and paying insurance as well.

ii) Absentees are paying additional taxes by way of the Land tax and Absentee Surcharge that well and truly grossly exceed any additional ‘ranges of taxes’ that they ‘may’ not be paying in their absence. The ‘generally not subjected to’ part of their rhetoric is a total falsehood used to hoodwink the Queensland public into buying their justification.

iii) Queensland Labor would be unable to provide evidence of the range of taxes that absentees are purportedly not paying in their absence that justifies the taxes that should only be aligned anyway to property – not to other tax revenue. I believe it is discriminatory for Labor to scrutinise what taxes an absentee may have been paying if in Australia instead. It is the democratic right for every citizen to spend their money how they deem fit and not be placed under the microscope of a government body to deem if they do or do not pay enough taxes, use particular services and utilities and spend their money in certain ways.

iv) Absentees may also reside in other Australian States and Territories outside Queensland, but own and hold a property in Queensland, therefore when in Australia any additional taxes being paid would be to the State/Territory that they reside in – on top of what they already pay in Queensland. The same applies of course for Queensland residents who own properties in other States and Territories in Australia who also do not pay additional taxes in those jurisdictions.

v) If a Queensland Australian citizen resident owning a property/ies in another Australian jurisdiction were to be absent for 6 months or more from Australia – those jurisdictions do NOT apply an Absentee Surcharge and increased rate of Land Tax. There is no Absentee surcharge for Australian citizens other than in Queensland. This is discriminatory and an unfair revenue gathering advantage taken by the QLD government.

vi) The ‘high quality services and infrastructure’ contributing to growth in Queensland properties is location specific. There would be many Queensland properties that will not benefit from infrastructure and services by ways of capital growth, because they are not in allocated catchment areas benefiting from that development and those services. This is a generalised comment that should not be used to warrant another excuse to impose these additional taxes. Regardless, the revenue collected by Queensland government was already pre-2017 budget being collected via the most relevant taxes (Commonwealth, State, Council).

vii) The ‘number of exemptions’ to the taxes are limited to only a small percentage of people who have specific employment criteria. Furthermore, there was no advance warning of this legislation pre-budget - so people already working overseas not meeting the criteria have been discriminated against as well. The stated undefined ‘numbers’ of exemptions being referred to would be insignificant compared to total absentees. The exemptions also fail to incorporate many circumstances whereby absentees through no fault of their own were already absent prior to the retrospective legislation being passed, having already significantly financially outlaid and committed to overseas movements and activities.

viii) It also fails to recognise those who for various reasons were and are unable to return within the 6 month ‘curfew’ period or who had already pre-booked/pre-planned such periods offshore. There are those who have for example (these examples are but a mere few of what would be an exhaustive list of possibilities but demonstrates real life issues):

- Are caring for sick loved ones or who are medically unfit unable to return themselves – or do so at their own peril;

- Have complex legal arrangements that are preventing them from returning on time;

- People suffering financial hardship and unable to return in time;

- People interned/imprisoned and hence unable to return within the 6 months;

- Retirees on long holidays already pre-booked and paid for, several already part way through their trips when the legislation was announced with no forewarning;

- People seeking rehabilitation overseas due to medical and psychological reasons;

- Employees who wish to take Long Service Leave, to take a career break from their jobs and travel and enjoy a period of life overseas. Some already overseas at the time when this legislation occurred and hit retrospectively too;

- Or others taking up education pursuits or contract work – opportunities that could benefit Australia with improved skills and knowledge.

ix) What the legislation in effect creates is a massive disadvantage to all Queensland property holders who wish to take advantage of education and employment opportunities overseas. Their interstate partners in the rest of Australia now have the distinct advantage of not being bound to 6-month ‘prison sentences’ to remain in Australia and hence able to apply for and take up those opportunities. This is blatant discrimination against Australian citizens owning property in Queensland who do not meet the limited exemption criteria. Queensland property owners therefore are more inclined to forego such opportunities due to the excessive and unsustainable Land Tax and Absentee Surcharge rates for absentees.

x) Restricting the free passage and movement of Australian citizens to work, live, travel in countries outside Australia from time to time or for parts of their life is a democratic right that should not be subjected to punitive measures to punish you (which in effect it is doing). This is what Queensland Labor under the rule of Premier Palaszczuk has implemented. It does not ring true of a Democratic constitution, rather a Communist one. This is a very dangerous precedent that has been allowed to slip in, quite surreptitiously at the time (the Treasurer Pitt did not elaborate much about and the media failed to properly recognise the new amendments also affecting Australian citizens), that was made retrospective as well.

xi) There were no provisions to start the amendments to property owners holding past a particular date. The Human Rights of individuals have been taken away – with economic hardship with financial and psychological devastation as an impact. I do not understand why the Scrutiny committee that I believed would have been appointed to review this legislation allowed it to be passed in the first place. It is an atrocity of justice.

In my circumstances I believe I have been discriminated against, have been unfairly treated, have had my Human Rights violated by a government of Australia, have and still am suffering severe financial and psychological distress – damage caused by Queensland Labor government. I am now being forced to live in and out of a suitcase and the only option available to me is to split my time between Australia and overseas 6 months at a time, which is completely disrupting, costly, unrealistic long term and ruinous to my personal disability rehabilitation and convalescing goals. I am rapidly deteriorating in my health as a result.

The Queensland Labor government’s amended legislation is causing more harm than good. The fallout from this legislation is still not quantifiable in total yet, but it is obvious there are terrible outcomes for most people caught in this legislation. Over a year on and the victims are already piling up. It is only a matter of time there will be statistics – suicides as a result.

Disturbingly I must note that correspondence I received from the Property Council of Australia was that they have received communication from Queensland Labor who seemed to think that as an absentee we were therefore considered ‘rich’ and as such deserved to have to pay. In other words – to be punished.

This reveals a severe ignorance as to the various circumstances surrounding absentees, who are on the whole, not rich. And regardless of anyone’s wealth, this should not be a reason to implement such taxes, especially when the budget comments stipulated it was to ensure absentees paid taxes they generally were not subjected to (which of course is false as well).

I respectively request that action is taken to determine the legality of the amended Land tax and Absentee Surcharge legislation contained in the Queensland Land Tax Act as of 2017. I submit that it is unconstitutional. I request that if deemed unconstitutional that legal proceedings are commenced to deem the legislation illegal to be removed forthwith. I will stand as a witness if required.

I thank you Sir/Madam Counsel in advance for your time and assistance in this matter.

Link to the Attorney General's Department in Canberra:

UPDATE 20 JAN 2019:

I have just received a response from the Office of Constitutional Law Canberra. Unfortunately it is not good news. The response outlines that Queensland is able to exercise certain autonomy - Land Taxes being one of those administered by the State. The other issue is that the Constitution "does not apply to people who are not residents of Australia or who are subject to disabilities or discrimination while they are out of Australia by the state of their residence when they are in Australia".

If the person returns and resumes residency, but is then charged the Absentee Surcharge and Land Tax bills whilst back in Australia. Is that an argument for discrimination under those circumstances?

Many others do not have the circumstances that permit them to return twice a year to fulfill the non-absentee criteria. It is disgraceful that Queensland is able to apply such punitive taxes.

Here is a copy of the letter:

Dear Mr Lehn

Thank you for your letter of 4 November 2018 regarding the Land Tax and Absentee Surcharge amendments introduced in Queensland. I also refer to your inquiry submitted on this department’s website on 30 December 2018 following up on your letter.

I appreciate the time you have taken to bring this matter to our attention and apologise for the delay in replying.

Neither the Attorney-General nor officers of this department provide legal advice to the public. If you have legal concerns about any particular laws or have legal queries, you may wish to seek independent legal advice. However, the following general comments may be of assistance.

The Australian Constitution establishes a federal system of government, under which powers are distributed between the Commonwealth and the states. This arrangement provides states with a large degree of autonomy over their own affairs. The land tax laws about which you are concerned are state laws. As such, your concerns regarding their operation are best directed to the Queensland government as you have done.

You refer to section 117 of the Constitution. In its terms, section 117 prevents a resident of a state from being subject to certain disabilities or discrimination in any other state. It does not apply to people who are not residents of Australia or who are subject to disabilities or discrimination while they are out of Australia by the state of their residence when they are in Australia.

Thank you again for bringing your concerns to our attention.

Yours sincerely

David Lewis

Acting General Counsel (Constitutional)

Office of Constitutional Law