A popular Property Chat forum I am subscribed to has a few people that respond who support/defend the QLD Absentee Surcharge and Land tax. It seems that they just accept the spiel provided by Labor as to why it is justified.

For them that makes it alright to tax the hell out of people so that they are left financially battered and wanting to hang themselves.

_______________________________________________

Here is a copy of the recent post made by a defender of the taxes who is a frequent poster on the Property Chat Forum:

FROM Paul@PFI:

Premier doesnt make the laws. She leads the party that governs. Parliament makes the laws. At the time the law was debated it was felt that the state of the QLD economy was adversely affected by Citizens and non-citizens and that non-occupant and investor demand was driving values up to the detriment of QLD resident seeking to buy property. So they wanted to soften this to remove off shore ownership driven demand. It has a side effect of harming some who leave Australia.

No better example of the effect of what happens when laws change long after you buy a property. Shorten now has plans of his own.

Extract of an estimates debate in QLD Parliament concerning the absentee provisions. Interesting to note that the absentee matter is not that new. Its been a part of laws for a LONG time but now a surcharge applies. There is also a link here to the EM handed to members at the time of debate. The policy impact is well documented and its intent is clear despite it seeming unfair it was adopted to curtail rising prices affecting QLD residents.

Ms TRAD: "For the benefit of the member for Everton, an absentee under the land tax act is a person who does not ordinarily reside in Australia including a person who is absent from Australia at 30 June or has been absent from Australia for more than six months, as I said in the original response. The concept of an absentee has been a part of Queensland’s land tax legislation for many years and its existence can be traced back as early as 1935. The government’s 1.5 per cent land tax surcharge applies to absentees who are liable for land tax if the value of their taxable landholdings is $350,000 or higher. The surcharge applies to land tax assessments from 2017-18 and is expected to generate $20 million in 2017-18. For example, if the taxable value of the absentee’s landholdings subject to land tax is $750,000, the surcharge will apply to the amount calculated as $750,000 less $349,999. The surcharge applies to absentees and is in addition to the current land tax rates for absentees, companies and trustees. There is a reasonable basis for introducing this modest surcharge to apply to absentees. The surcharge ensures that absentee owners of land are making a fair contribution towards taxes that are used to deliver and maintain high standards of service and infrastructure in Queensland. Absentee owners benefit, such as through the capital appreciation of their landholdings, from the high standard of services and infrastructure delivered and maintained by a broad range of taxes in Queensland borne by resident taxpayers. Resident Queensland persons who are liable for land tax are not affected by the surcharge and continue to benefit from the higher tax-free threshold and lower land tax rates applying to individuals". Mr MANDER: "Thank you for that confirmation—"

MY RESPONSE:

"The surcharge applies to absentees and is in addition to the current land tax rates for absentees, companies and trustees. There is a reasonable basis for introducing this modest surcharge to apply to absentees. The surcharge ensures that absentee owners of land are making a fair contribution towards taxes that are used to deliver and maintain high standards of service and infrastructure in Queensland. Absentee owners benefit, such as through the capital appreciation of their landholdings, from the high standard of services and infrastructure delivered and maintained by a broad range of taxes in Queensland borne by resident taxpayers."

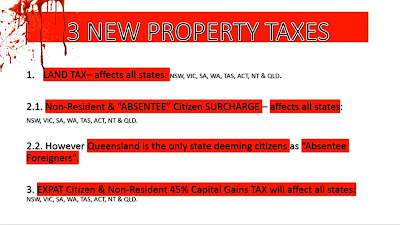

The Absentee concept has been in law for a long time but the taxing of Australian citizens as Absentees is a first (not to be mixed up with the longer term non-resident applicable taxes imposed by the Commonwealth - which also allow for far more leeway and exemptions for the 'non-resident' category).

The justification spiel that the Labor government provides is utter rubbish. Firstly, the surcharge is not 'modest'. It is massive. Totally and utterly exorbitant and impacts people immensely. If people get bills that turn them suicidal and/or financially crippled then one has to ask, did they go too high in the percentages? Yes they did. My bill was ridiculously high, wiping out 2/3 of my rental income. Others with higher land values have been hit with even worse bills. A retired couple who embarked on a world adventure got slammed with over $20,000 bill. Others right up there and beyond. Has put travel restrictions on nearly all Queensland property owners (most will not be able to afford the ridiculously inflated tax bills).

The double tax (Absentee surcharge plus the Land tax at reduced threshold) are way and beyond the taxes that residents are making, so that any apparent taxes not being paid in absence (would be along the lines of taxes from utility use, mobile, internet, road tolls, public transport, motor vehicle registration and then GST from local shopping etc - Commonwealth taxes anyway). Most Australian absentees are paying water & sewer connection & service rates, council, electricity connection, insurance, income taxes (salary or investments), and other State/Commonwealth taxes. Plus usual holding costs for a property.

Before the new Absentee surcharge - Australian citizens who spend time abroad past the 6 months and not meeting the 'normally reside' test were already contributing by paying taxes. It was never the case that they were not paying enough. That is total and utter BS. The gullible citizens sucked in to this rhetoric or sitting on their hands have just handed over another freedom.

Foreign citizens on the other hand - ok there is an argument there for implementing the surcharge and hiked land taxes. They may well just be holding a vacant property and not contributing other than paying holding costs and mandatory rates and impacting on house prices for 'Australians'.

You should look at the Victorian inquiry into the impact of the Absentee Surcharge and why they did not implement it on Australian citizens there. In fact New Zealanders were also exempted (so New Zealanders - foreign citizens, have more freedoms than Aussies owning property in Queensland).

The 'infrastructure' argument - not all property owners will benefit anyway from infrastructure - that is very location specific.

Bottom line is Queensland went way too far and have forced a good population of Australians who are overseas for a myriad of reasons (just like Aussies in neighboring States) to be smashed with these taxes, others having to now return to Australia and pull the pin on holidays, long term or contract work, education, scholarships, volunteers, expats, retirees, extended family visits, career breaks, long service leave etc etc). Disadvantaging Queenslanders from taking up opportunities overseas compared to their State/Territory neighbours who can go without punishment. Most will push you into absentee status. Good luck arguing with the Treasurer over your normal residence for that financial year. From feedback the Treasurer will deem you an absentee unless you can prove otherwise.

The Queensland Pensioners and Superannuants' League QLD were only recently made aware of these taxes when one of their members got hit with it. A shock bill. That's because of the sneaky way it was introduced. They are horrified. Several retirees who have/are planning for bucket list long haul adventures have either been slammed with a massive bill or now have to reduce or cancel their overseas dream adventures. Nice way to treat your own Aussies.

Palaszczuk herself went over to London University to complete a scholarship years ago. Gee, I wonder how it would be if she had owned a property in QLD back then and there was this Absentee surcharge? Unless she was well off, she would most likely passed up that opportunity and remained in Oz. She would quite possibly not have advanced her career to where she is today. Just like many other Aussies now owning QLD property now need to weigh up such decisions since 2017 budget. How bloody restrictive, backwards thinking and punitive this is. It is just too unfair for Australians.

Me and other Queenslanders and interstate Aussie Queensland property owners never signed up to being prisoners of the State thank you. We are not foreigners. We are Australians. Turning Aussie investors, owner/occupiers away from Queensland.

If you are affected please join my group Queensland land Tax and Absentee Surcharge Victims' Support Group on Face Book.

________________________________________________

Of course I expect the trolls now to attack with 'eye rolling' emojis and other comments about it just being a 'whinge' , 'non-convincing' etc. Most likely absolute devotees to Labor, Labor - maybe even Labor MPs themselves,investors not wanting any bad news about QLD property market to adversely affect their investments (i.e. vested self interests), and/or just total socialists, protectionists, etc.

The 2017 Labor Government Budget introduced changes to the Land Tax Act that causes nearly all Australian citizens owning property in Queensland, who are overseas for 6 months or more in a financial year, to be subjected to a combined Land Tax (at a reduced threshold) as well as an Absentee Surcharge at 1.5% of the value of your land. Prisoners of the State.

Sunday 20 January 2019

Sunday 13 January 2019

Complaint submitted to the Anti Discrimination Commission Queensland

8 January 2019 I lodged a complaint to the Anti-Discrimination Commission Queensland. The discrimination complaint I submitted included the argument that Queensland Property owners labelled as 'Absentees' are being discriminated because we are subjected to the Absentee Surcharge and a/higher Land Tax compared to people not regarded as 'Absentees'.

The fact that Australians had already committed to being overseas prior to the legislation changes means that it unfairly treats those of us subjected to the taxes. Many absentees had already made arrangements to move overseas as well at great cost and no warning was given about the upcoming changes - in fact we were all hit retrospectively.

Queensland property owners considered absentees are also discriminated because people owning property in other states are not subjected to the same punitive restrictions and penalties - meaning that they are free to take up opportunities that Queensland absentees cannot. This is a severe disadvantage.

Unfortunately though, the QLD Human Rights Bill has not yet been passed. If the Bill becomes an Act - according to their website:

"The Human Rights Act will start in two stages. The first stage in mid-2019 will start the functions of the Commission to provide information about human rights. The second stage will start the rest of the Act, including the complaint process, on 1 January 2020."

NOTE: I inadvertently submitted a complaint to the QLD Anti-Discrimination Commission twice (8 Jan 2019 and 12 Jan 2019) - as I have been submitting to Federal bodies as well (in this case - the Human Rights Commission - complaint rejected as not in their jurisdiction to investigate complaints against State bodies) and forgot I had already made a submission.

15 Feb 2019 Update:

I just received a response from the Anti Discrimination Commission Queensland.

Unfortunately another brick wall. Here is a copy of the response:

Thank you for sending us your complaint.

Under section 136 of the Anti-Discrimination Act 1991 (the Act), a complaint must set out reasonably sufficient details to indicate an alleged breach of the Act.

Your complaint does not appear to come under the Act because the worse treatment does not appear to have happened in an area covered by the Act. The Act does not cover the government of the day’s enactment of legislation it sees fit to pass. The Anti-Discrimination Act covers the administration of those laws as described in section 101 of the Act, but not the right of the government to introduce taxes and enact legislation.

Your complaint seems to be one that may be best handled by approaching your local state member of parliament to describe the impact of the legislation on you and your specific circumstances.

I hope this information is helpful to you.

Example of how a family in Victoria can take a long travel adventure overseas but Queensland property owners cannot without punishing taxes.

EXAMPLE OF HOW QUEENSLAND PROPERTY OWNERS ARE DISADVANTAGED FROM OTHER STATES WHERE AUSTRALIAN PROPERTY OWNERS CAN TRAVEL WITH IMPUNITY

Please read and then watch the video below:

I just watched this story televised on Channel 10's The Project about an AirBnB disaster story. Terrible what happened. Over $20,000 in damage. But at least this family who leased out their property are from Victoria. They took off on a 10 month overseas adventure for them and the kids.

You see, that's something Queensland property owners CANNOT do. You need to reduce that to under 6 months. And hope and pray nobody gets sick or injured that prevents you getting back before the 6 month clock alarm rings.

Otherwise, you are going to pay dearly with the MASSIVE special rate Land Tax and Absentee Surcharge. And that is something most Australian owners of property in Queensland cannot afford.

A $20,000 tax bill is worse. Why? Because unlike a damage bill, this terrible experience with dodgy tenants won't likely be repeated. That means they and others owning outside QLD can rent their homes out and take that travel adventure overseas - enriching the experience and minds of their children.

But the QLD taxes stay around your neck forever charging you EVERY TIME you exceed 6 months.

Queensland property owners are being treated like children who need to be home in time by their Labor 'parents' or be punished.

Be warned - Queensland government monitor your immigration movements and tally up the absent periods. So don't think you could get away with it. Plus, not notifying the Office of State Treasury of your extended absence could attract further fines and interest charged too.

Thanks Dictator Palaszczuk and Curtis Pitt and the rest of QLD Labor cronies for ruining and restricting our freedoms and lives.

I need to say I envy people like this who have freedom of movement and impunity. Unlike us.

Please read and then watch the video below:

I just watched this story televised on Channel 10's The Project about an AirBnB disaster story. Terrible what happened. Over $20,000 in damage. But at least this family who leased out their property are from Victoria. They took off on a 10 month overseas adventure for them and the kids.

You see, that's something Queensland property owners CANNOT do. You need to reduce that to under 6 months. And hope and pray nobody gets sick or injured that prevents you getting back before the 6 month clock alarm rings.

Otherwise, you are going to pay dearly with the MASSIVE special rate Land Tax and Absentee Surcharge. And that is something most Australian owners of property in Queensland cannot afford.

A $20,000 tax bill is worse. Why? Because unlike a damage bill, this terrible experience with dodgy tenants won't likely be repeated. That means they and others owning outside QLD can rent their homes out and take that travel adventure overseas - enriching the experience and minds of their children.

But the QLD taxes stay around your neck forever charging you EVERY TIME you exceed 6 months.

Queensland property owners are being treated like children who need to be home in time by their Labor 'parents' or be punished.

Be warned - Queensland government monitor your immigration movements and tally up the absent periods. So don't think you could get away with it. Plus, not notifying the Office of State Treasury of your extended absence could attract further fines and interest charged too.

Thanks Dictator Palaszczuk and Curtis Pitt and the rest of QLD Labor cronies for ruining and restricting our freedoms and lives.

I need to say I envy people like this who have freedom of movement and impunity. Unlike us.

YouTube Channel created - Land Tax & Absentee Surcharge

I have created a new YouTube channel today titled 'Queensland Land Tax & Absentee Surcharge'

I have uploaded a video that appears on another channel (Property Club channel), but this channel will be dedicated solely the Queensland Absentee Surcharge and accompanying Absentee rate Land Tax - as it affects Australian citizens.

Here is the link to the YouTube channel where you can select videos from:

Land Tax & Absentee Surcharge YouTube Channel

I have uploaded a video that appears on another channel (Property Club channel), but this channel will be dedicated solely the Queensland Absentee Surcharge and accompanying Absentee rate Land Tax - as it affects Australian citizens.

Here is the link to the YouTube channel where you can select videos from:

Land Tax & Absentee Surcharge YouTube Channel

Wednesday 2 January 2019

Would you have bought a Queensland property if you knew you had a six month travel restriction linked to your property being taxed?

You know my answer. I am 99.99% sure I know the rest of your answers. Problem is they never gave us the choice. Sprung upon us without warning.

And for those who may have bought after the changes, it was not well documented and in fact many people still do not know about it.

Premier Palaszczuk went to London for University Scholarship - what if she had been an Absentee back then?

Imagine, you are awarded a scholarship to study abroad in a university to enhance your career prospects. An opportunity like this was given to Premier Palaszczuk at the University of London. She took up the offer.

This was before she came into power. But I wonder - did she own a property then in Queensland? If so she would be an 'Absentee' by today's standards.

But of course there was no Absentee Surcharge and accompanying hiked Land Tax to hinder her decision. Most likely if she owned a property that fell within the absentee category then she would have foregone the offer due to massive costs and she could quite possibly not ended up as a Premier. But opportunities like that were afforded to all Queenslanders and QLD property owners back then. There was no disadvantage. She, like other non-Queensland property owners today could and can take up those sort of life changing offers.

Queensland property owners subject to the absentee rules cannot.

Palaszczuk, I wonder? Have you forgotten your past and how that scholarship helped you to get to where you are now? Do you want your Queensland voters to not have the same opportunities made available without punitive taxes to prevent them leaving the country?

I am also including not just scholarships but many other reasons why Queenslanders and Australians go abroad for parts of their lives. If it was okay for you then why not for us Palaszczuk? Do we not count as anything at all? Are we just your property to control like a dictator? Because that is what it feels like.

DOUBLE STANDARDS.

(UPDATED 21 MARCH 2019 - story submitted on Medium website. Link below)

Queensland Premier Palaszczuk was an absentee before legislation changed

Queensland's property tax hit means some investors might have to sell

Another article discovered from last year and posted here for information purposes. This was published in the Australian Financial Review 24 Nov 2017 by reporter Matthew Cranston. Titled 'Queensland's property tax hit means some investors might have to sell'.

It outlines the impact on an investor caused as a result of the Land Tax & Absentee Surcharges that were introduced in May 2017 as well as the additional tax hikes for higher end properties that were implemented at the end of 2017.

Investor and Australian expat living and working in Singapore - Rembert Meyer-Rochow at the time of the article, stated he was thinking of selling his Gold Coast property due to his Land Tax bills being pushed to over $100,000!

The article also mentions, Queensland developer 'Consolidated Properties', property firm JLL and the Australian Property Council, who are all firmly against the Labor government's new property tax laws.

Steve Douglas, a fellow of the Taxation Institute of Australia and co-founder and managing director of Australasian Taxation Service also points out the need as well for foreign investment to maintain a balanced supply in the market.

Real-estate/Queenslands-property-tax-hit-means-some-investors-might-have-to-sell

YouTube Videos discussing Queensland Land Tax & Absentee Surcharge + Capital Gains Tax on non-resident Australian citizens

A YouTube video was created and submitted by a group member (and also Absentee tax victim) Peter James who also runs Facebook Group and YouTube channel 'Property Club'. I also contributed to this video to briefly discuss the impacts of the Land Tax & Absentee Surcharge as well as the capital gains tax on non-residents with removal of the Primary Residence (Principal Place of Residence PPR) CGT exemption when becoming a non-resident.

Media via YouTube is a great way to spread the word to the general public. We need all Queenslanders to become well aware of what's going on. We need the rest of Australia to also see what is going on.

Queensland Land Tax & Absentee Surcharge Victims' Support Group - Facebook page link

Other videos created and submitted by Peter relating to Queensland and property tax:

I was interviewed by Peter over the phone in this video we we discuss the QLD Land Tax & Absentee Surcharge.

Subscribe to:

Posts (Atom)

A $1 billion hit to the Queensland budget as property market slides

A $1 billion hit to the Queensland budget as property market slides A $1 billion hit to the Queensland budget as property market slides

-

Article revealing that Queensland is now 6th place in the State of States report released by Commsec. Opposition treasurer Tim Mander is sca...

-

A BRIEF SUMMARY OF WHAT HAS HAPPENED TO AUSSIES OWNING PROPERTY IN QUEENSLAND - NO LAUGHING MATTER. In the 2017 Queensland Labor St...

-

Here is the letter I have completed for submission to the Senior Counsel - Office of the Constitution of Law Attorney General's D...