NO NEWS YET ON BILL REGARDING SCRAPPING OF CGT TAX EXEMPTION FOR NON-RESIDENT OWNING A PRIMARY RESIDENCE

No news it seems yet on the Morrison government's implementation of legislation regarding the CGT exemption removal for Primary Residence holders who become non-residents. All set to go by end of June 2019. I for one have sold off a property in anticipation of the bill being passed so as to avoid a future 'non-resident' Capital Gains tax at the Foreign Resident Rate (nil CGT discount allowed). They only grandfathered this until next year but many expats are still in extreme anxiety and uncertainty as to what to do - they cannot sell their properties because of the severe market downturn, but do not want to have to sell their properties when deemed non-residents either. But because of the market downturn expats are being forced to sell their properties at a huge loss, instead of holding. The ATO website still outlines the new laws but states:

"In the 2017-18 Budget, the government announced that foreign residents will no longer be entitled to claim the main residence exemption when they sell property in Australia. This change is not yet law and is subject to parliamentary process.

If the law is passed and you are a foreign resident when a CGT event happens to your residential property in Australia, you may no longer be entitled to claim the main residence exemption. This will apply to you:"

Capital-gains-tax International-issues - Foreign-residents-and-main-residence-exemption

Great that they can just keep everyone in a perpetual limbo. It may be the case the bill is never passed through the senate and I and several others have sold their properties for nothing and at a considerable loss of capital/loss. Extremely unfair. Was only implemented as part of Morrison (Treasurer at the time) and Turnbull's strategy to take the heat off the housing market - yet again Australian citizens are caught up in the net. Well. we all know how that's panned out with a massive housing crash enveloping Australia. There was no need and there is no need for this CGT exemption removal to continue. Forcing expats to ditch Australia and move cash into riskier assets classes to draw income streams.

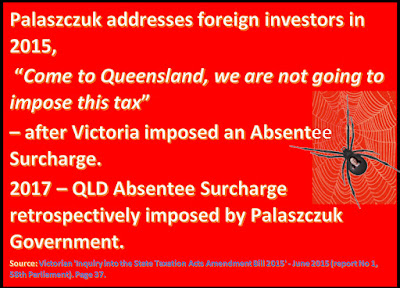

As I have outlined before - owning a property in Queensland and being an Absentee under QLD Law, being a Non-Resident under Federal Law and owning a Primary Residence - you are set to the be worst off property owners in all of Australia. Triple taxes stacked against each and every one of us wishing to stay overseas with a damned 6 month travel limit.

Not to mention Foreign Resident income tax with zero tax-free threshold. Then there are local taxes you pay in the countries you are staying in plus usual taxes and other holding costs of your property/ies in QLD.